tucson sales tax rate 2019

Tubac AZ Sales Tax Rate. SOUTH TUCSON Ariz.

Property Taxes In Arizona Lexology

SALES TAX INFORMATION FOR TUCSON ARIZONA SALES TAX FORMS The sales tax rate for Pima County is currently 61.

. Sales Tax Increase Effective. In November 2017 Tucson resident voters approved a tenth of a percent increase to the City of Tucson sales tax rate. Arizona has state sales tax of 56 and.

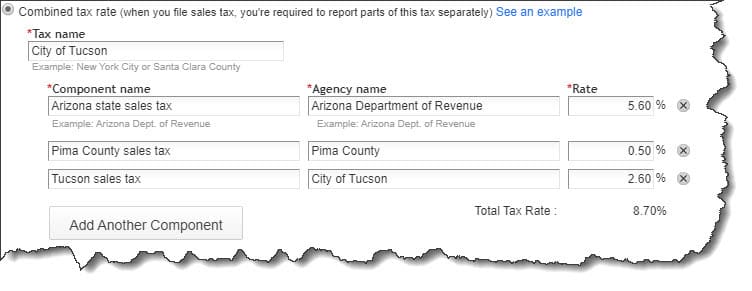

Local General Sales Tax AZ State Sales Tax Globe 330 560 Miami 350 560 All tax rates subject to change without notice. 19-01 to increase the following tax rates. Average Sales Tax With Local.

Public Utility Additional Communications 105. Accordingly effective February 1 2018 the rate rose from. Tucson Estates AZ Sales Tax Rate.

127 rows Among major cities Chicago Illinois and Long Beach and Glendale California impose the highest combined state and local sales tax rates at 1025 percent. The sales tax jurisdiction name is Arizona which may refer to a local government division. Tucson AZ Sales Tax Rate.

Groceries and prescription drugs are exempt from the Arizona sales tax. You can print a 87 sales tax table. On May 16 2017 Tucson resident voters approved a 5-year half-cent increase to the City of Tucson sales tax rate.

4 rows The current total local sales tax rate in Tucson AZ is 8700. This is the total of state county and city sales tax rates. If you need to buy a big-ticket item say a new refrigerator you could save some money by buying where the sales tax is lower.

KOLD News 13 - The City of South Tucson city council narrowly approved a measure increasing the citys sales tax rate to 11 percent on Monday. Tumacacori AZ Sales Tax Rate. The total tax rate state county and.

The Arizona AZ state sales tax rate is currently 56. For example retail food sales for home consumption are taxed the lowest at 15 percent but only generated 83359 in six months between July 2018 and January 2019. On July 15 2019 the Mayor and the Council of the City of South Tucson approved Ordinance No.

The minimum combined 2022 sales tax rate for Tucson Arizona is 87. Sales tax is a tax paid to a governing body state or local for. Effective July 1 2017 the rate will rise from 20 to 25.

Retail Sales 017 to five percent. The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817. The current total local sales tax rate in tucson az is 8700.

The City of Tucson tax rate increased effective July 1 2017 from 2 to 25 for most business activities and increased effective March 1 2018 from 25 to 26 for those same business. The decision on Tuesday raises the total sales tax inside the square-mile city to 111 compared to the city of Tucsons total sales tax rate of 87. There is no applicable special tax.

If you itemize tax. You will need to apply for an Arizona Transaction Privilege Tax. The Arizona sales tax rate is currently 56.

The City of Tucson receives 2 tax from all taxable sales by businesses located within the city limits regardless of the customers location. 6 rows The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and. Murph continues his Sales Tax 2018 RV journey into 2019 with states he still hasnt toured yet this week he is hitting parts of Arizona.

The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. A 1500 refrigerator purchased in. The City of South Tucson primary property tax rate for Fiscal Year 2017-2018 was adopted by Mayor Council at 02487 per hundred dollar valuation.

Depending on local municipalities the total tax rate can be as high as 112.

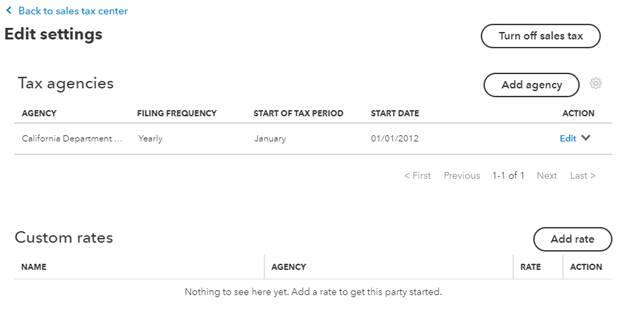

How To Process Sales Tax In Quickbooks Online

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

Rate And Code Updates Arizona Department Of Revenue

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

5 Things You Need To Know About Sales Tax In Quickbooks Online

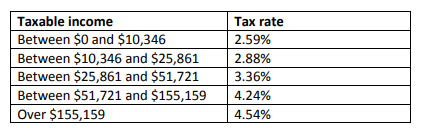

What S The Arizona Tax Rate Credit Karma Tax

Sales Tax Rates In Major Cities Tax Data Tax Foundation

1 How Much Sales Tax Does Trina S Trinkets Owe Each State In 2019 In Your Answer List All States In Which Trina S Operates But If Trina S Does Course Hero

State And Local Taxes In Arizona Lexology

1 How Much Sales Tax Does Trina S Trinkets Owe Each State In 2019 In Your Answer List All States In Which Trina S Operates But If Trina S Does Course Hero

Merchants Rio Nuevo Downtown Redevelopment And Revitalization District Tucson Az

State And Local Taxes In Arizona Lexology

1 How Much Sales Tax Does Trina S Trinkets Owe Each State In 2019 In Your Answer List All States In Which Trina S Operates But If Trina S Does Course Hero